ARR Vs. MRR – Which One is the Right Metric for your SaaS Business in 2023

- Angel Alfred

- March 6, 2023

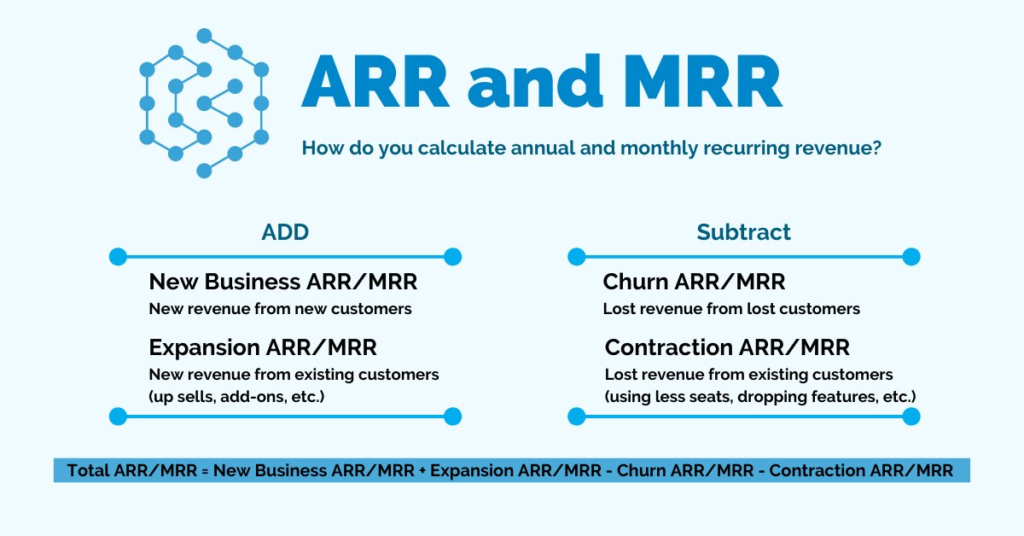

There are various metrics that SaaS businesses can use to measure their performance, but two of the most important are Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR). Choosing the right metric can be a tough decision, as both ARR and MRR have their benefits and drawbacks. That’s why in this blog post, we will take a closer look at ARR Vs. MRR, and explore the differences between them.

What are SaaS Business Models?

SaaS, or Software as a Service, is a software delivery model that allows businesses to access software applications over the internet. Rather than purchasing and installing software on their computers, users subscribe to the software as a service and access it through a web browser or application interface.

SaaS business models typically involve a monthly or annual subscription fee for access to the software, as well as ongoing updates and support. The advantage of this model for businesses is that it allows them to avoid the up-front costs of purchasing and installing software, as well as the ongoing costs of maintaining and updating it.

One key feature of SaaS is its scalability. Because the software is delivered over the internet, it can be accessed by users anywhere in the world, and the service can be scaled up or down depending on demand. This means that businesses can quickly and easily add new users or features as needed, without having to invest in additional hardware or software.

Another important aspect of SaaS business models is the focus on customer retention. Because users are typically paying for ongoing access to the software, providers must prioritize customer support and ensure that their product is constantly updated and improved. This requires a customer-centric approach, with a focus on understanding and meeting the needs of users.

The Importance of Tracking Metrics for SaaS Businesses

Tracking metrics is essential for SaaS businesses to understand their performance and make informed decisions about their future. SaaS companies operate in a highly competitive and rapidly evolving market, where data-driven insights are critical to success. Metrics provide insights into user behavior, product performance, and revenue growth, among other areas.

One of the most important metrics for SaaS businesses is customer acquisition cost (CAC). CAC measures the amount of money a company spends to acquire a new customer. This metric is crucial because it helps companies understand how much they can spend on customer acquisition while maintaining profitability. Companies with a high CAC will struggle to grow sustainably, while those with a low CAC can scale more quickly.

Another critical metric for SaaS businesses is monthly recurring revenue (MRR). MRR measures the predictable, recurring revenue generated by a company’s customers each month. This metric is important because it provides a clear picture of a company’s revenue stream and growth potential. Companies that can increase their MRR are better positioned to invest in product development and customer acquisition.

The churn rate is another essential metric for SaaS businesses. The churn rate measures the rate at which customers cancel their subscriptions or fail to renew them. A high churn rate indicates that a company is struggling to retain customers, which can negatively impact revenue growth. Companies with a low churn rate can achieve sustainable growth and maintain profitability.

Understanding ARR

ARR is a metric used by businesses to measure the amount of revenue they expect to receive from their subscription-based products or services over a year. It is the key indicator of a business’s financial health and sustainability in the long term.

Advantages of Using ARR as a Metric

ARR, or Annual Recurring Revenue, is a crucial metric for businesses that offer recurring subscription-based services or products. It represents the total amount of revenue that a company expects to receive annually from its customers who are subscribed to its recurring services or products. ARR is an essential indicator of a company’s financial health as it reflects its ability to generate consistent revenue over a prolonged period.

One of the significant benefits of ARR is that it helps companies to forecast future revenue more accurately. By measuring the amount of revenue that will be generated from the current customer base, companies can determine the growth potential of their business and plan their investments accordingly. This data is essential for making informed business decisions, such as whether to scale up or down the business or invest in new product development.

ARR is also useful in measuring customer retention and loyalty. A high ARR indicates that customers are satisfied with the services or products being offered and are likely to continue their subscription in the future. This information can help companies identify which services or products are most successful and profitable, allowing them to allocate resources accordingly.

Cloud provider cloudera uses ARR as the primary metric that management uses to monitor customer retention and growth.

Calculation of ARR

ARR or Annual Recurring Revenue is a financial metric that measures the yearly revenue a company expects to generate from its subscribers or recurring customers. It is an important metric to determine a company’s revenue and growth potential.

The formula to calculate ARR is straightforward. Simply multiply the Monthly Recurring Revenue (MRR) by 12. For example, if a company’s MRR is $10,000, then the ARR would be $120,000 ($10,000 x 12).

Read: All About ARR (Annual Recurring Revenue) and How to Calculate It in 2023

Understanding MRR

Monthly Recurring Revenue (MRR) is a key metric used by businesses that offer subscription-based services or products. It represents the total amount of revenue generated from these recurring subscriptions every month. MRR is a critical metric for businesses that rely on recurring revenue streams as it provides an accurate representation of the company’s monthly revenue.

Advantages of Using MRR as a Metric

MRR provides a predictable and stable revenue stream, allowing businesses to forecast their revenue for the upcoming months. This helps businesses plan for growth and manage their expenses more effectively. MRR is an important metric for businesses that are seeking funding or looking to sell their business. Investors and buyers often look at MRR to determine the value of a business.

MRR can be used to track customer retention rates. A decline in MRR can be a sign that customers are canceling their subscriptions, indicating a need for businesses to improve their product or service offering. By tracking MRR, businesses can identify growth opportunities and make informed decisions about how to invest in their product or service offering. MRR can help businesses identify which subscription plans are the most popular and which ones need improvement.

MRR provides an important performance metric for businesses to measure their success over time. By tracking MRR, businesses can see if they are growing or if they need to make changes to improve their revenue stream.

MRR is a crucial metric for subscription-based businesses as it provides a clear picture of the company’s recurring revenue stream, which can be used to make informed business decisions. By tracking MRR, businesses can forecast their revenue, plan for growth, and identify areas for improvement.

Calculation of MRR

MRR is calculated by multiplying the number of subscribers by the monthly subscription price. For example, if a company has 100 subscribers and the monthly subscription price is $50, the MRR would be $5,000.

This calculation provides a clear picture of the company’s recurring revenue stream, which can be used to make informed business decisions.

Read: 5 Rules for Creating MRR-Revving Lead Magnets in Minutes

Differences Between ARR and MRR

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) are two popular metrics used to track the revenue generated by subscription-based businesses. The primary difference between ARR and MRR is the frequency of revenue measurement. ARR measures the total revenue generated annually by a customer’s subscription, while MRR measures the total revenue generated monthly by a customer’s subscription.

Advantages and Disadvantages of Each Metric

ARR provides a long-term view of revenue growth and can be useful for predicting revenue for the upcoming year. It also helps to identify the company’s overall customer base, as it measures revenue from all customers in a year. However, the disadvantage of ARR is that it can mask fluctuations in revenue over time, as it only measures revenue annually.

On the other hand, MRR provides a more accurate view of the revenue growth rate and revenue trends over time. It also helps to identify churn rates by measuring revenue lost monthly from canceled subscriptions.

However, the disadvantage of MRR is that it can be affected by seasonality and fluctuations in revenue in the short term.

Examples of When to Use ARR and MRR

ARR is typically used by enterprise-level businesses that have long-term contracts or customers who sign up for a year or more. It can be used to forecast revenue and measure the overall health of the business.

MRR is typically used by startups and SaaS businesses that have monthly subscription plans. It provides a more granular view of revenue growth and can help identify the impact of changes in pricing, features, or other factors on the monthly revenue. It is also useful for identifying churn rates and can be used to measure customer acquisition costs and customer lifetime value.

ARR and MRR are both important metrics for measuring the revenue generated by subscription-based businesses. The choice of which metric to use depends on the business model and the length of the subscription contract. ARR provides a long-term view of revenue growth, while MRR provides a more accurate view of revenue trends over time.

Choosing the Right Metric for Your SaaS Business

Choosing the right metric for your SaaS business is crucial for understanding and measuring the performance of your business. Metrics can help you track progress, identify areas of improvement, and make informed decisions.

With so many metrics available, it can be challenging to determine which one is best for your business. Two common metrics used in SaaS businesses are Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR). Understanding the differences between these two metrics can help you determine which one is best suited for your business.

Factors to Consider When Choosing Between ARR and MRR

When deciding between ARR and MRR, there are a few factors to consider. One factor to consider is the type of SaaS business you have. For example, if you have a business that requires annual contracts, such as enterprise software, ARR may be the better choice as it provides a clear view of your annual revenue. On the other hand, if your business relies on monthly subscriptions, such as a consumer-facing software product, MRR may be a more appropriate metric.

Another factor to consider is how frequently you want to track your revenue. ARR provides a snapshot of your annual revenue, while MRR provides a more granular view of monthly revenue. If you want to track revenue every month, MRR may be the better choice. If your business is growing rapidly, MRR can provide a more accurate representation of your revenue growth.

The Importance of Aligning your Metric with Your Business Goals

It’s essential to align your metric with your business goals to ensure you’re measuring the right things. For example, if your goal is to increase monthly recurring revenue, then tracking MRR will be more appropriate. If your goal is to increase annual revenue, then tracking ARR will be more appropriate. Aligning your metric with your business goals ensures that you’re measuring the right things and can help you make informed decisions to achieve your objectives.

Hence, choosing the right metric for your SaaS business is critical for understanding and measuring the performance of your business. When deciding between ARR and MRR, consider factors such as the type of SaaS business you have, how frequently you want to track revenue, and your business goals. Aligning your metric with your business goals ensures that you’re measuring the right things and can help you make informed decisions to achieve your objectives.

Conclusion

The choice between the two metrics depends on the specific needs and goals of the business. It’s important to understand the nuances of each metric and how they can be used to inform strategic decision-making and drive growth. By utilizing both metrics effectively, businesses can gain a comprehensive understanding of their revenue streams and optimize their operations for sustained success.

Share This Post

Angel Alfred

Angel is a digital marketer, a mental health speaker, and above all, a writer. She loves being a part of the RocketHub team and is keen on learning and taking over new challenges every day!

Table of Contents

Get The Latest Updates

Subscribe To Our Weekly Newsletter

Sign up below to be one of the first crew members onboard and get early access to amazing deals.

Recent Posts

Social Media

Categories

Related Posts

Lifetime Deal Platforms

The best lifetime deal platforms for software. Platforms lik RocketHub scour the web for the highest quality products to bring buyers the best lifetime deals on their platform.

How to Work for Yourself + 13 Solo Business Ideas

Do you ever wonder if being your own boss could truly set you free? In this article, we’ll explore the theory that unleashing entrepreneurial freedom

7 Reasons Why Every SaaS Team Needs Interactive Demos

Making a Case for Interactive Demos: 7 Reasons Why Every SaaS Team Needs Them Let me paint a scenario for you. You want to buy