7 Best Startup Funding Ideas

- Angel Alfred

- December 10, 2021

There is an old saying that says money doesn’t grow on trees, and we couldn’t agree more. However, if you have a great idea for a SaaS solution, there will always be ways to secure startup funding.

Investors and banks have figured out that these fresh ideas and concepts are what drive the economy and that potential return rates on these investments can supersede almost anything they could’ve earned otherwise.

There is more to it than your traditional investors. Let’s keep reading to find out.

Bootstrapping

One of the oldest ways to start a company is self-funding. It isn’t something that works for all the projects. However, it can be a good solution during the initial development stages. It can work especially well for services as costs are not as high as with some other types of projects. The best thing about bootstrapping is that all the profits go back into your pocket.

Often, those bootstrapping their startup have another stream of revenue, which covers their cost of living. You can use your savings to bootstrap your company, or you can take a personal loan. As the sales grow, and profits are reinvested, the company will slowly and organically grow. Bootstrapping your company is not the fastest path to commercial success, but it has one main benefit which is you maintain full ownership of your company and your ideas.

Examples of Successful Bootstrapped SaaS Startups

Let’s find out the people who took a step to become the pioneers of this bootstrapping revolution.

Canny

Canny is a SaaS customer feedback app, founded by ex-Facebook employees Sarah Hum and Andrew Rasmussen. Having completed the Y Combinator Startup School (a free 10-week program to educate founders), they proceeded to work on building the product without any outside investment.

Seven months after launching the product, the pair were proud to announce that they’d reached “ramen profitability”, covering both their business and personal expenses, all while traveling the world.

Instapage

It is a SaaS Startup owned by Tyson Quick. He bootstrapped the company out of necessity, rather than choice. In a recent interview with Forbes, he highlighted just how critical the situation was for him in the early days. He claims that his customers get up to 400% more from their digital ad spend with his startup, Instapage.

Once the momentum started to pick up, Tyson realized that they wouldn’t need to raise capital at all, and continued to power the company’s growth through revenue. Fast forward to 2017 and Instapage has over $10M in revenue and 130 employees across multiple countries.

Storemapper

Tyler Tringas is the owner of Storemapper. He refers to his startup as an interesting case for bootstrapping, primarily because his company Storemapper was built from the ground up as a “Micro-SaaS”.

So the entire product was optimized to be lean right from the beginning. Recently, after 5 years of operation, Tyler sold the business and documented the entire process.

Grants from The Government

Governments and certain organizations tend to provide a boost to young startups. They can give them one-time startup funding without any collateral, interest, or equity. These grants can vary significantly from country to country and usually have to do with its economic policies.

If we are talking about grants that the US government provides, these are grants for socially-oriented companies. So, if you’re doing business within the education, medicine, or the alternative energy field, you should definitely ask around about these grants. Keep in mind that while these are one-way grants and there is no financial obligation of any kind, however, there might be some other rules or limitations in place that you need to adhere to.

Examples of Government Websites to Find Grants

There are a wide variety of grants from the government from both the federal and state level. Here are some of them.

GRANTS.GOV

The first place all small businesses should go to look for a federal grant. It’s a database of thousands of grants with powerful filters that will help you quickly narrow down the results to grants that you have a good chance of getting.

SAM.gov

This is another great federal grant database with a modern re-design. While there is some overlap with Grants.gov, you’ll find a few unique ones as well that make it worth your time to check. You can use the advanced search filters to only see grant results, or also see other funding sources like loans.

Challenge.gov

This technically isn’t a site that offers grants, but they do offer significant amounts of prize money for solving challenges facing a variety of industries. Many are technology-oriented, but there are non-tech challenges as well. If your business is doing something innovative, monitor Challenge.gov for relevant challenges that might be easy for your small business to win.

Contests

If you pay attention, you will find out that contests are everywhere. The prize money might not be huge, but it could just be the financial injection your SaaS-startup needs. And the great thing is you do not need to hand over ownership, or pay interest.

Of course, participating in a contest means you will have to play by their rules. Entry conditions may vary but, if you can participate, take the opportunity. Even if you do not win, a contest provides ample opportunity to put your SaaS startup in the spotlights. Often, performing a pitch is an important part of a contest.

Examples of Successful Contests

Here are some examples of contests that offer startup fundings. Take a look at them and maybe, make a plan to participate!

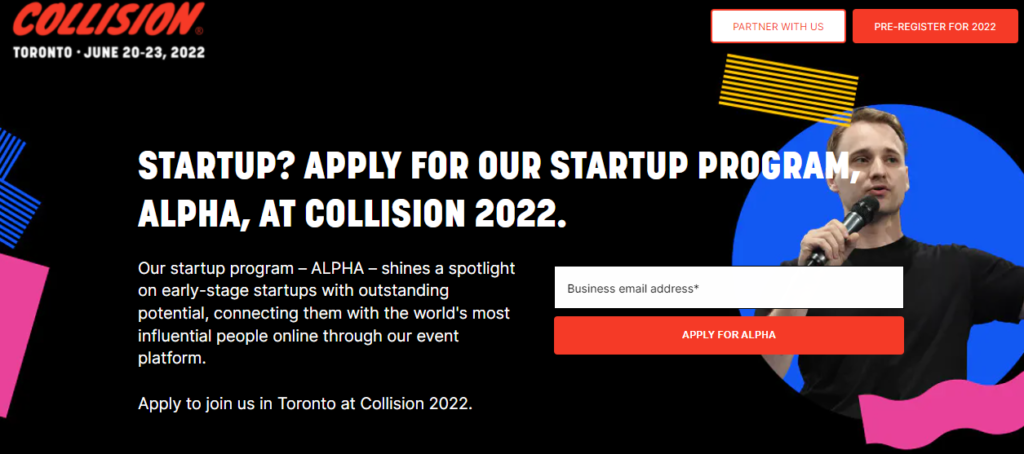

Collision 2022

Despite the change of venue this year, bringing its 25,000 attendees to Toronto after three years in New Orleans, Collision still remains the fastest-growing tech conference in the US.

Attend various startup workshops, get in-person advice from investors and join the ultimate startup battle at PITCH, the contest section of the conference where you can compete for three days with the top 70 startups, in order to be crowned the winner.

European Social Innovation Competition

If you’re an EU citizen and believe your project/business idea can impact society, then this competition was made for you. Run across all European countries by the European Commission, the European Social Innovation Competition focuses on innovative projects, products, and services with a social aspect. Now in its seventh year, the challenge prize, launched in memory of Diogo Vasconcelos, aims to empower young people.

U.Pitch 2022

An elevator pitch competition (you’ll only get 90 seconds) geared towards college students, to attend U. Pitch you must be currently enrolled or have graduated with the past six months. Future Founders, who believe that every youth can become an entrepreneur, bring together students from different universities to showcase their ideas in front of the entrepreneurial community.

Accelerators

Accelerators and incubators are a pretty interesting concept for startup funding. They are mostly focused on training and networking instead of providing funds. However, if needed, they will also fund an enterprise but in that case, they will expect an ownership stake in return.

These organizations are really unique but they don’t work for all types of companies. Instead, they are ideal for businesses that heavily depend on networking and communication. They can also be good for people who have amazing business ideas but not enough business experience. An individual can learn a lot in this environment before starting an enterprise of their own.

Examples of Popular Accelerators

Here is the list of some popular accelerators and incubators that could be your choice in getting startup funding.

MassChallenge

MassChallenge has grown over the past decade to include six early-stage and two vertical accelerators across five continents. Almost 2,000 startups funded by MassChallenge have raised a total of $4.3b and generated total revenue upwards of $2.5b.

Unlike almost every other accelerator out there, MassChallenge takes 0% equity from startups that go through its program. It’s not uncommon for an accelerator to take ownership of 10% of the company post-graduation, so MassChallenge startups are better-positioned than most to sell equity to investors and use it to attract top talent.

Y Combinator

Founded in 2005, it’s practically one of the oldest startup incubators. So far they’ve funded over 2,000 startups, with household names such as Airbnb, Dropbox, and Reddit among them. The Y Combinator community numbers more than 4,000 founders and their portfolio of companies has a combined valuation exceeding $100 billion.

If your startup is early stage, you can take advantage of Y Combinator’s biannual 3-month program, during which time you will relocate to Silicon Valley to work closely with their team. The companies will get the opportunity to get their offering in shape and get on a path to growth by targeting further investments.

AngelPad

Based in New York and San Francisco, the accelerator program has worked with more than 150 companies with an average funding of 11 million USD for each. They have a really impressive track record, having been ranked as the Top U.S Accelerator by MIT’s Seed Accelerator Benchmark every year since 2015. One of their many notable alumni companies, Postmates, has raised $578,000,000 to date, was last evaluated for $1.9 billion, and filled IPO this year.

Every 6 months, they select 15 teams for their intensive 3-month program. The applications are certainly many, but if you are on the lucky one you will get funding, mentorship, as well as prepping in a wide range of subjects such as product-market fit, getting validation, preparation for fundraising, and more. Mostly, you will have the opportunity to become a part of their lively community of founders and form connections to investors.

Crowdfunding

Crowdfunding is a very typical way of getting money. It is increasingly popular among young people and at the same time, it is a good way to analyze your product before it even hits the shelves. Unfortunately, due to the fact this is a relatively new concept, there are lots of different problems and something could even get your company into legal issues. So, if you decide to go this startup funding route, it is very important to learn more about crowdfunding in advance.

This is probably one of the best ways to fund your company as it doesn’t require you to give much in return. For example, when you set up a page on Kickstarter or a similar platform, you can disclose your goals in advance. The more person gives, the more he or she will get in return. Sometimes, these can be extra collectibles or items that cannot be bought otherwise.

This is precisely why crowdfunding is great for the gaming industry as well as other types of publishing businesses.

One of the newest crowdfunding concepts is equity crowdfunding. With it, your startup can seek out a large number of small investors. This is opposite to concepts such as venture capital funds where one fund can solve all your issues. Of course, when you opt for equity crowdfunding, you need to provide these small investors with something in return.

Examples of Successful SaaS Crowdfunding Projects

Thinking about seeking out some number of small investors through crowdfunding? Check out some projects below.

Oculus

Oculus, the massively popular virtual reality headset, was purchased by Facebook for $2 billion in 2014. But, before that, the company launched on Kickstarter seeking $250,000 to develop the Oculus Rift headset. Within four hours, the campaign reached its target; the campaign eventually raised $2.4 million.

Glowforge

Glowforge broke Pebble’s crowdfunding record, raising $27.9 million in one month. This high-tech, 3D laser printer lets people use everything from leather to plastic to make products. Not only is the product neat, but the company offered it at a significant discount during its crowdfunding campaign. Then, in 2018, the company raised another $10 million from other investors.

Flow

Flow Hive is a beehive box for your home that makes it easy to extract honey from the hive without disturbing the bees. In 2015, Flow Hive started a campaign on Indiegogo seeking $70,000 to bring their product to market. The page went viral: Flow Hive raised $250,000 on pre-orders and broke a number of Indiegogo’s records, becoming the fastest campaign to reach $2 million. Eventually, the product raised over $13 million.

Angel Investors

An angel investor is a type of venture capital investment. However, in this particular case, instead of a company that gets its funds from institutional investors, we are talking about single individuals who have large assets at their disposal.

What are the benefits and the drawbacks here? Unlike venture capital firms, angel investors ask for a much larger piece of the pie. On the other hand, these individuals are usually very successful investors with sizable financial experience. As such, they are willing to provide much better marketing support and they will often help with training with an emphasis on finances.

Unfortunately, this also means they will have much more impact on the business and also, much more control. These investments range from 25,000 to 250,000 dollars.

The amount of money you can get is much lower compared to that from venture capital funds. This makes angel investors ideal for small or medium businesses that don’t require too much scaling. Perhaps the best thing about angel investors is that this type of relationship is informal and because of that, there is much more flexibility and negotiating when making a contract.

Angel Websites to Find Investors for Your Startup

If you are looking for angel investors, you can take a look at some websites below.

Angel List

AngelList is a website dedicated specifically to helping tech startups raise funds, recruit team members, and launch their businesses with the assistance of angel investors. It’s easy for people to find jobs at a startup on this website and invest in companies that they’re interested in once they join AngelList, which is why it’s very popular among startups that are looking to grow.

The blog that’s maintained on this website centers around investing and angel investors. Some of the topics that are written about on this blog include how to set up a remote team, how to incorporate diversity into your hiring process, and the importance of agile methodology. If you want to follow AngelList, their Facebook and Twitter accounts are very active with regular updates, the latter of which has more than 380,000 followers.

Life Science Angels

Life Science Angels is a top angel investment group that focuses primarily on such industries as biotechnology, pharmaceuticals, medical devices, and diagnostics. Many of the angel investors in this group are senior executives or founders of companies in the healthcare industry.

When you visit their website, you can apply for funding and obtain tips on applying, which can be very helpful in reducing the number of mistakes you make on your application.

Tech Coast Angels

Tech Coast Angels is a popular angel investment firm with regional networks extending from the Central Coast to San Diego. They have over 400 investors and provide startups with mentoring, knowledge, connections, and assistance with building their businesses. They offer these services to startups in sectors like life sciences, biotech, software, and information technology.

Their website provides information to entrepreneurs in the form of blog articles and other resources. These include tips on what angel investors are looking for, so even if Tech Coast Angels isn’t where you want to apply, their resources may be useful. Their social media presence is centered on Facebook and Twitter, the latter of which provides regular updates that can be helpful when you want to learn more about this investment firm.

Venture Capitalists

The final source of startup funding we will be discussing is venture capital. This is the most professional form of finance available to SaaS startups. Most venture capitalists focus their attention on a specific sector or geographical region. The trick with venture capitalists is to provide them with a solid plan. Venture capitalists offer access to large capital, but they do want something in return. Convincing them that your SaaS solution will turn the world upside down is just the first step.

You will need to do more. You will need to have a product that is ready to be shipped, even if it is just the minimum viable product or MVP. And they very much like to see some track record.

Venture capitalists want to participate in a startup, but they do have a time horizon. They will never take a stake in your company if there is no exit plan. Working out a deal with a venture capitalist can be difficult, but in return, you are provided with a large capital injection, expert advice, operational support, and usually access to a strong business network.

Examples of Venture Capitalists

Check out some venture capitalists below and do some research if you want to try to pitch them in the near future.

Rolling Funds

They allow fund managers to get new capital in the form of automatic, quarterly commitments, which allow them to start investing sooner and with only a fraction of the traditional amount required. Angel syndicates let newer investors join forces with seasoned angels, and learn from their experience across deals.

RareBreed Ventures

It is an example of a pre-seed fund providing founders outside of large tech ecosystems with an open door they wouldn’t usually get from traditional VC firms. The fund allows angel investors to become limited partners for larger funds down the line. That’s important because it gives angels, typically investors with a more human contact approach and greater proximity to emerging business, the power to make higher-level capital decisions.

Backstage Capital

A VC industry leader in investing in women, people of color, and LGBT founders, allows accredited investors to join deals through its Backstage Crowd syndicate. They even curate select crowdfunding opportunities from its portfolio for people who have not accredited investors under the Securities and Exchange Commission regulations or are not in the United States.

Conclusion

Startups are companies that want to grow at a breakneck speed. They need a huge sum of capital to finance their growth and scale fast enough. With so many alternatives, choosing the best source of startup funding may be a daunting task. However, considering the advantages each source listed above can help you decide which one to pursue.

Share This Post

Angel Alfred

Angel is a digital marketer, a mental health speaker, and above all, a writer. She loves being a part of the RocketHub team and is keen on learning and taking over new challenges every day!

Table of Contents

Get The Latest Updates

Subscribe To Our Weekly Newsletter

Sign up below to be one of the first crew members onboard and get early access to amazing deals.

Recent Posts

Social Media

Categories

Related Posts

Lifetime Deal Platforms

The best lifetime deal platforms for software. Platforms lik RocketHub scour the web for the highest quality products to bring buyers the best lifetime deals on their platform.

How to Work for Yourself + 13 Solo Business Ideas

Do you ever wonder if being your own boss could truly set you free? In this article, we’ll explore the theory that unleashing entrepreneurial freedom

7 Reasons Why Every SaaS Team Needs Interactive Demos

Making a Case for Interactive Demos: 7 Reasons Why Every SaaS Team Needs Them Let me paint a scenario for you. You want to buy