How to Calculate SaaS Customer Lifetime Value (LTV) in 2023

- Angel Alfred

- February 9, 2023

With the booming market for software-as-a-service (SaaS) products, businesses of all sizes are turning to SaaS to streamline their operations and improve customer experience. However, as with any business decision, understanding the cost and return of a SaaS investment is essential for success. In this blog post, we’ll discuss how to calculate SaaS customer lifetime value (LTV) to understand the potential return on a SaaS product.

What is SaaS Customer Lifetime Value (LTV)?

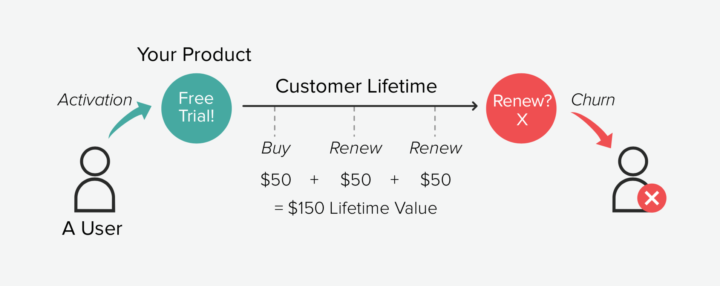

SaaS Customer Lifetime Value (LTV) is a metric that measures the total value a customer is expected to bring to a Software-as-a-Service (SaaS) business over the entire length of their relationship. It is used to estimate the potential revenue a customer will generate for a business through recurring payments over time, including renewal or expansion of their subscription.

LTV can be calculated by multiplying the average revenue per user (ARPU) by the average customer lifespan (customer retention rate divided by churn rate). This helps SaaS businesses understand the long-term value of acquiring and retaining customers, and helps them make informed decisions about customer acquisition costs (CAC), pricing, and product development.

The calculation of LTV is not an exact science, as it relies on projections and assumptions about future customer behavior. However, it provides a valuable tool for SaaS companies to evaluate the economic value of their customers and prioritize investments in customer acquisition and retention efforts.

Understanding SaaS Revenue Streams

Recurring revenue streams are a critical aspect of the software as a service (SaaS) business model. The main idea behind recurring revenue streams is to provide a predictable and steady flow of income for the company. This is achieved by selling software subscriptions or services to customers regularly, typically on a monthly or annual basis.

One of the key factors in determining the long-term value of a customer (LTV) is segmenting revenue streams. Segmentation involves breaking down revenue streams into smaller, manageable parts, allowing for a more accurate assessment of each stream’s contribution to the overall revenue of the company.

This information is then used to make informed decisions about which revenue streams to focus on, which to grow, and which to potentially cut or eliminate.

Types of Recurring Revenue Streams in SaaS

There are several different types of recurring revenue streams in SaaS, including subscription revenue, usage-based revenue, and revenue from upsells and cross-sells. Subscription revenue is generated from customers who pay a regular fee for access to the software. Usage-based revenue is generated based on the amount of usage of the software by the customer. Upsells and cross-sells refer to the sale of additional products or services to existing customers.

Another type of recurring revenue stream in SaaS is service revenue, which is generated by providing professional services such as support, training, and consulting. Finally, licensing revenue is generated by licensing the software to other companies or organizations for their use.

Understanding the different types of recurring revenue streams in SaaS and segmenting them for LTV calculation is crucial for the success and growth of the business. It allows companies to focus on the revenue streams that are the most profitable and make informed decisions about how to allocate resources and grow the business.

Identifying Key Metrics for LTV Calculation

Lifetime value (LTV) is a prediction of the net profit attributed to the entire future relationship with a customer. To calculate LTV, you need to identify key metrics such as customer acquisition cost (CAC), average revenue per user (ARPU), and average customer lifespan. The following metrics help understand the revenue generated from a customer over time, and the cost involved in acquiring and retaining that customer. Let’s go ahead and find out their relevance.

Average Revenue per User (ARPU)

ARPU is the average amount of revenue generated by a single user over a specific period. This metric helps in understanding the revenue generated per user and is calculated by dividing the total revenue by the number of users. ARPU is an important metric in LTV calculation as it provides a clear picture of the revenue generated from a user over time.

Customer Churn Rate

Customer churn rate is the percentage of customers who stop using a company’s product or service over a specific period. It is a critical metric as it helps in understanding the rate at which customers are leaving and the impact it has on the overall revenue. A high churn rate can be an indicator of a problem with the product or service and can lead to a decrease in LTV.

Read: SaaS Churn 101 – Average Rate, How to Calculate, and More

Gross Margin Percentage

Gross margin percentage is the difference between the revenue and the cost of goods sold (COGS) divided by the revenue. This metric helps in understanding the profit margin before accounting for other expenses such as marketing and operations. Gross margin percentage is an important metric in LTV calculation as it provides a clear picture of the profitability of the company and its ability to generate revenue from each customer over time.

Average Customer Lifespan

Average customer lifespan is the average amount of time a customer continues to use a company’s product or service. This metric helps in understanding the length of the customer-company relationship and is an important factor in LTV calculation as it provides a clear picture of the revenue generated from a customer over time. A longer customer lifespan typically leads to a higher LTV, as the customer continues to generate revenue for the company over a longer period.

Calculating Average Revenue per User (ARP)

Average Revenue per User (ARPU) is a key metric used by SaaS (Software as a Service) businesses to measure the average revenue generated by each user. It provides valuable insights into the overall financial performance of the business, allowing companies to make informed decisions about pricing, customer acquisition, and product development.

The formula for Calculating ARPU

The formula for calculating ARPU is simple:

Total Revenue ÷ Total Number of Users

It is important to consider all revenue streams in the ARPU calculation, including subscription fees, one-time purchases, and any additional services or products sold to users.

The importance of considering all revenue streams lies in getting a complete picture of the financial performance of the business.

For example, a SaaS business that only considers its subscription revenue may appear to be performing well, but if it is missing out on additional revenue from other sources, it may not be as profitable as it seems.

Examples of ARPU Calculation

Examples of ARPU calculation for different types of SaaS businesses:

- Subscription-based SaaS: In this model, customers pay a monthly or annual fee for access to the company’s software. To calculate ARPU, the total subscription revenue is divided by the total number of subscribers.

- Freemium SaaS: In this model, customers have access to a basic version of the software for free, with the option to upgrade to a paid version for additional features. To calculate ARPU, the total revenue from paid subscribers is divided by the total number of paid subscribers.

- Enterprise SaaS: In this model, companies offer their software to large organizations on a contract basis, often with custom pricing arrangements. To calculate ARPU, the total revenue from each customer is divided by the number of users within that customer organization.

ARPU is an important metric for SaaS businesses to track and understand. By accurately calculating ARPU and considering all revenue streams, companies can make informed decisions about their financial performance, pricing strategies, and product development.

Determining Customer Churn Rate

Determining the Customer Churn Rate refers to the process of calculating the percentage of customers who have discontinued their use of a product or service over a specified period. This metric is an important indicator of a company’s performance and is often used to assess the effectiveness of retention efforts.

The formula for Calculating Customer Churn

The Formula for calculating customer churn rate is relatively simple and can be expressed as:

Customer Churn Rate = (Number of Customers Lost / Total Number of Customers) * 100

It is important to note that the total number of customers used in the calculation should be consistent, either using the number at the beginning of the period or the average number of customers over the period. The period used to calculate the churn rate can vary, but it is commonly done on a monthly, quarterly, or yearly basis.

Tracking and Monitoring Customer Churn

Tracking and monitoring customer churn is important for a variety of reasons. Firstly, it allows a company to identify patterns and trends in customer behavior and make data-driven decisions to improve retention efforts.

For example, if a company sees a spike in churn in a particular region, it can investigate the reasons and take action to address the issue.

Secondly, customer churn can have a significant impact on a company’s revenue, as acquiring new customers can be much more expensive than retaining existing ones. Tracking churn can help a company to understand the effectiveness of its retention strategies, allowing it to make continuous improvements over time.

Determining the customer churn rate, understanding the formula for calculating it, and tracking and monitoring it are all important steps in ensuring the long-term success of a company. By understanding why customers are leaving, a company can take steps to improve its retention efforts and maintain a healthy customer base.

Estimating Gross Margin Percentage

Estimating Gross Margin Percentage refers to the process of determining the percentage of revenue that remains after deducting the cost of goods sold (COGS) from the total revenue. Gross margin is an important metric that provides valuable insights into the profitability of a business and its ability to generate profits from sales.

The definition of gross margin is the difference between revenue and cost of goods sold (COGS) divided by revenue.

The gross margin percentage is calculated as follows:

Gross Margin Percentage = (Revenue – COGS) / Revenue * 100

Importance of Considering Direct and Indirect Costs in Gross Margin Calculation

It is important to consider both direct and indirect costs when calculating the gross margin percentage. Direct costs are the costs directly related to the production of a product, such as materials and labor. Indirect costs are the costs that are not directly related to production, but still impact the cost of goods sold, such as overhead expenses, marketing, and other indirect costs.

Considering both direct and indirect costs in gross margin calculation is important because it provides a more accurate picture of the true cost of producing and selling a product. By including indirect costs, businesses can see the full impact of their expenses on the bottom line and make informed decisions about pricing, production, and other key aspects of their operations.

A higher gross margin percentage indicates that a business is generating more revenue after covering its costs and is therefore more profitable. Monitoring and analyzing gross margin percentages over time can also help businesses identify trends and make decisions to improve their financial performance.

Determining Average Customer Lifespan

Determining the average customer lifespan (ACL) is an important metric for SaaS (Software as a Service) companies as it helps in estimating the potential revenue from a customer over their lifetime. ACL is defined as the average period a customer continues to use the service or product offered by the company.

Factors Affecting Average Customer Lifespan in SaaS

Several factors can impact the average customer lifespan, including customer satisfaction, product quality, pricing, competition, market trends, and changes in customer behavior or needs.

For instance, if a customer is satisfied with the service and finds it valuable, they are more likely to continue using it, resulting in a longer ACL. On the other hand, if the product quality is poor or the pricing is too high, the customer may switch to a competitor, which will result in a shorter ACL.

The significance of considering historical data and market trends in determining the average customer lifespan cannot be overstated. Historical data can provide valuable insights into past customer behavior and the factors that have impacted their ACL.

This information can be used to make informed decisions and predictions. Market trends, on the other hand, can provide information about the current state of the market and the competition. This information can be used to identify any potential threats or opportunities that may impact the ACL.

Determining the average customer lifespan is a crucial aspect of the business strategy for SaaS companies. By considering the factors that affect ACL, historical data, and market trends, companies can make informed decisions and predictions about the potential revenue from their customers over their lifetime. This information can be used to optimize their business strategy and ensure long-term success.

Calculating SaaS Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) is a prediction of the total value a customer will bring to a business over their lifetime as a customer. In the context of SaaS (Software as a Service) businesses, LTV is a crucial metric that helps businesses understand the value of each customer and make informed decisions regarding customer acquisition and retention.

The Formula for Calculating LTV

The formula for calculating LTV is:

LTV = (Average Revenue per User (ARPU) * Gross Margin%) / Customer Churn Rate

where ARPU is the average amount of revenue generated per user each month, Gross Margin% is the percentage of revenue left after subtracting all the costs of goods sold, and Customer Churn Rate is the percentage of customers who stop using a product or service over a given period.

Importance of Considering Key Metrics in LTV Calculation

It is important to consider all key metrics in LTV calculation to ensure that the result is as accurate as possible. This includes factors such as customer acquisition costs, customer lifetime, and the rate of revenue growth. Failing to consider these metrics can result in an overly optimistic or pessimistic estimate of LTV, which can lead to incorrect decisions regarding customer acquisition and retention.

For example, a SaaS business that specializes in project management software may have an ARPU of $50 per user per month, a Gross Margin% of 80%, and a Customer Churn Rate of 5%.

Their LTV would be:

LTV = ($50 * 0.80) / 0.05 = $800

On the other hand, a SaaS business that offers online courses may have an ARPU of $20 per user per month, a Gross Margin% of 70%, and a Customer Churn Rate of 10%.

Their LTV would be:

LTV = ($20 * 0.70) / 0.10 = $140

These examples highlight the importance of considering all key metrics in LTV calculation and how the results can vary greatly between different types of SaaS businesses. By accurately calculating LTV, SaaS businesses can make informed decisions regarding customer acquisition and retention, which can ultimately lead to increased revenue and growth.

Wrapping Up

Calculating the customer lifetime value of SaaS products can be a complex process. However, understanding the LTV of your customers is essential for successful growth and long-term sustainability. By understanding the key factors that influence customer LTV and applying the appropriate calculations, SaaS companies can make informed decisions and ensure their continued success.

Share This Post

Angel Alfred

Angel is a digital marketer, a mental health speaker, and above all, a writer. She loves being a part of the RocketHub team and is keen on learning and taking over new challenges every day!

Table of Contents

Get The Latest Updates

Subscribe To Our Weekly Newsletter

Sign up below to be one of the first crew members onboard and get early access to amazing deals.

Recent Posts

Social Media

Categories

Related Posts

Lifetime Deal Platforms

The best lifetime deal platforms for software. Platforms lik RocketHub scour the web for the highest quality products to bring buyers the best lifetime deals on their platform.

How to Work for Yourself + 13 Solo Business Ideas

Do you ever wonder if being your own boss could truly set you free? In this article, we’ll explore the theory that unleashing entrepreneurial freedom

7 Reasons Why Every SaaS Team Needs Interactive Demos

Making a Case for Interactive Demos: 7 Reasons Why Every SaaS Team Needs Them Let me paint a scenario for you. You want to buy